📅 Last updated: December 27, 2025

3 min read • 485 words

Quantum computing represents one of the most profound technological frontiers of our time, promising to reshape industries from pharmaceuticals to finance. For investors, it presents a unique convergence of monumental potential and significant uncertainty. This guide distills timeless investment principles and strategic frameworks for evaluating this nascent sector, focusing on enduring analysis rather than fleeting stock picks.

Understanding the Quantum Investment Thesis

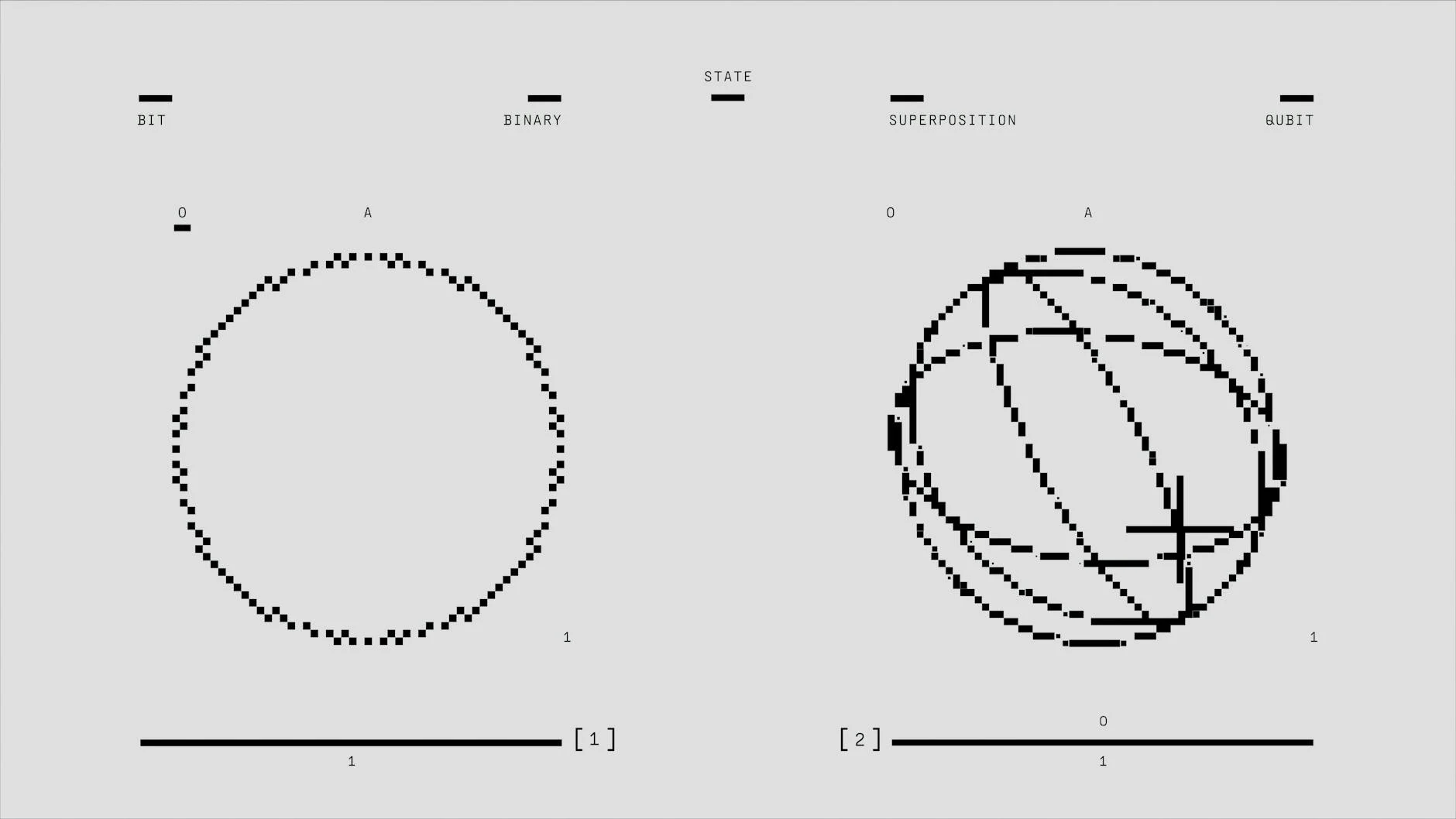

At its core, quantum computing leverages the principles of quantum mechanics—superposition and entanglement—to process information in ways fundamentally different from classical computers. The long-term investment thesis rests on its potential to solve specific, complex problems that are currently intractable, such as:

- Advanced Material Discovery: Simulating molecular interactions to create new drugs, batteries, or catalysts.

- Logistics & Optimization: Revolutionizing supply chain management and financial portfolio optimization.

- Cryptography: Both breaking current encryption standards and creating quantum-secure networks.

The key for investors is to recognize that this is not a replacement for classical computing, but a specialized tool for particular, high-value challenges.

The market is not a winner-takes-all race for a “quantum PC,” but a layered ecosystem developing over decades.

Timeless Investment Principles for a Speculative Sector

Applying disciplined investment strategy is paramount in a field rife with hype. Consider these evergreen principles:

1. Focus on the Ecosystem, Not Just Hardware:

The most successful technological revolutions create entire ecosystems. Look beyond companies building the quantum processors themselves. The “picks and shovels” approach can offer less risky exposure. This includes:

- Specialized Software & Algorithms: Companies developing the tools to program quantum machines.

- Cryogenics & Control Systems: Providers of the extreme cooling and precision control hardware essential for quantum stability.

- Quantum-as-a-Service (QaaS): Firms offering cloud-based access to quantum processors, enabling broader commercial and research adoption.

2. Prioritize Financial Resilience and Optionality:

Quantum computing is a capital-intensive, long-term R&D endeavor. Favor companies with:

- Strong Balance Sheets: Ample cash reserves or profitable core businesses that can fund a decade of development without excessive dilution.

- Multiple Avenues for Value Creation: Companies where quantum is a strategic bet alongside other viable revenue streams. This “optionality” provides a margin of safety if timelines stretch.

3. Assess Management and Scientific Credibility:

In a deep-tech field, the quality of the team is a critical intangible asset. Scrutinize:

- Team & Academic Pedigree: The track record and reputation of the scientific leadership.

- Realistic Roadmaps: Management that communicates clear, staged milestones without resorting to hype.

- Strategic Partnerships: Alliances with established tech firms, national labs, or industry consortia that validate the approach and provide resources.

Key Takeaways

- Quantum computing is a specialized tool for specific complex problems, not a general-purpose computing replacement.

- Investment analysis should focus on the entire ecosystem, including enabling hardware, software, and services.

- Financial resilience and a long-term capital runway are critical factors for companies in this sector.

- Management quality and scientific credibility are paramount intangible assets to evaluate.

- Maintain a portfolio perspective, viewing quantum as a strategic, long-term allocation within a diversified investment strategy.