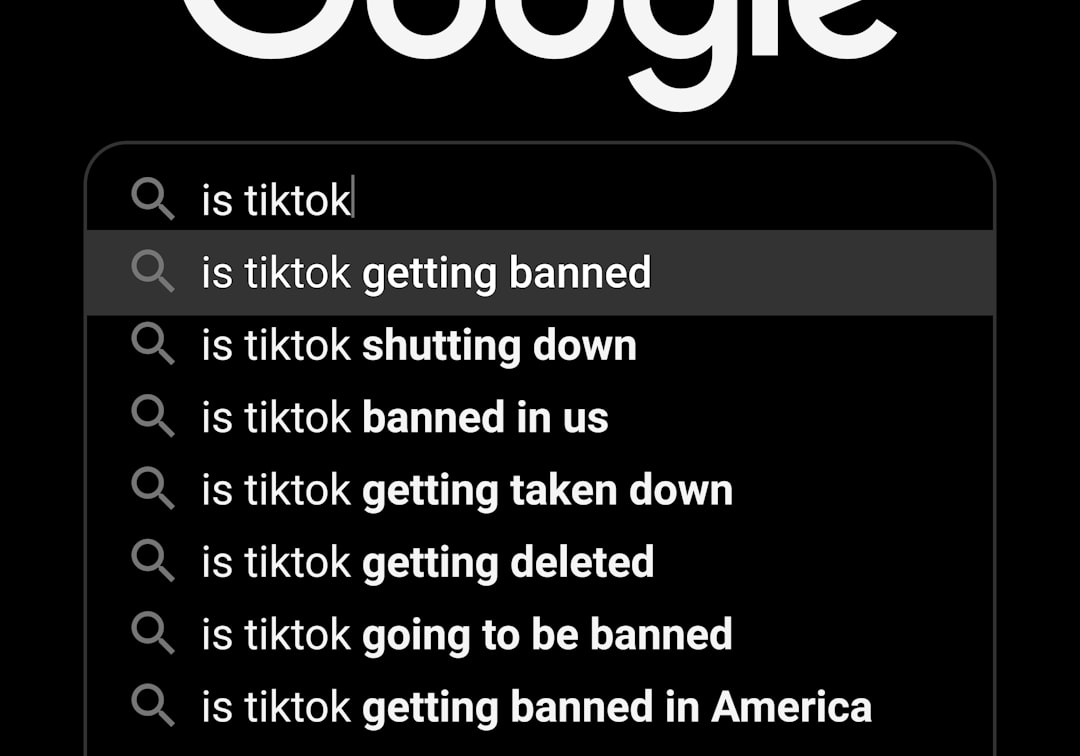

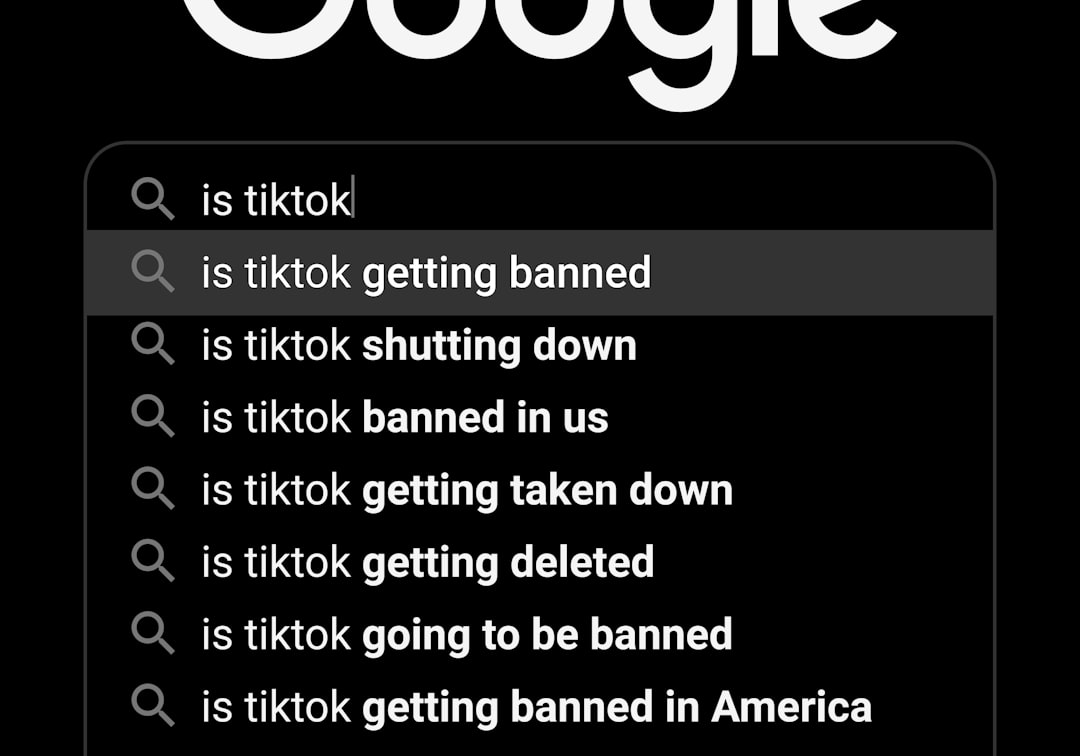

Introduction

In a high-stakes resolution to a geopolitical standoff, TikTok has engineered a dramatic escape from a U.S. ban. The social media giant’s survival hinges on an unprecedented corporate restructuring, creating a new American-controlled entity. This deal, set to finalize in early 2026, doesn’t just save an app—it rewrites the rulebook for global tech operations in an age of digital nationalism.

The Anatomy of a $60 Billion Lifeline

The core of TikTok’s survival is TikTok USDS Joint Venture LLC, a new corporate entity with ownership shared between Oracle, investment firms Silver Lake and MGX, and ByteDance itself. Valued at an estimated $60 billion, this structure is a legal and financial masterstroke. It technically complies with the U.S. law demanding ByteDance’s divestment while allowing the Chinese parent to retain a significant economic stake and some operational influence through complex licensing agreements.

For the 170 million American users, the immediate experience may not change. The familiar interface and addictive ‘For You Page’ will remain. However, the underlying machinery—data flows, algorithm training, and content moderation—will shift under the stewardship of the U.S.-led joint venture. Oracle will become the guardian of U.S. user data on its cloud servers, a key concession to longstanding national security concerns.

A Timeline Forged by Political Whims

The path to this deal was anything but linear. The original “divest-or-ban” law, signed in January 2026, set a ticking clock. What followed was a year of tense negotiations, political theater, and repeated presidential reprieves. Former President Donald Trump, who once sought to ban the app, became an unexpected architect of its salvation, signing multiple extensions and a pivotal “Saving TikTok” order that pushed parties toward this hybrid solution.

This stop-and-start process revealed deep confusion even among the law’s proponents. Many lawmakers admitted they were unsure of the technical feasibility of a full separation. The eventual compromise reflects a pragmatic, if messy, understanding: an outright ban was politically untenable and economically disruptive, but unchecked Chinese control was unacceptable. The joint venture became the only viable off-ramp.

The Oracle Gambit: Ellison’s Digital Kingdom Expands

Larry Ellison’s Oracle emerges as the most powerful winner in this arrangement. Beyond securing a massive, sticky cloud contract, Oracle gains unprecedented access to one of the world’s most influential recommendation algorithms. This partnership catapults the enterprise software giant into the heart of consumer social media and AI. Analysts speculate this move is less about ads and more about data intelligence, positioning Oracle as a critical bridge between U.S. security interests and cutting-edge AI development.

Ellison’s deep involvement, including direct negotiations with Trump and ByteDance, underscores the deal’s strategic importance. It represents a fusion of Silicon Valley capital, Washington’s security agenda, and global tech ambition. For Oracle, running TikTok’s U.S. backbone is a trophy asset that strengthens its hand against cloud rivals like AWS and Microsoft Azure in the government and regulated industry sectors.

Unanswered Questions and Looming Challenges

Despite the signed agreements, critical details remain shrouded in secrecy. The exact governance structure—who has the final say on algorithm updates or content policies—is unclear. Can U.S. authorities truly audit an algorithm whose core intellectual property may still reside with ByteDance engineers in Beijing? Furthermore, the “retrained” algorithm, promised to be free of foreign manipulation, is an unproven concept. Its effectiveness and neutrality are yet to be tested.

Another major question surrounds global precedent. Will the European Union, India, or other nations demand similar localized ownership structures? This deal could inspire a wave of “tech sovereignty” mandates, Balkanizing the internet further. For ByteDance, the model may become a template to keep its app operational worldwide, but at the cost of ceding control market-by-market.

The Geopolitical Ripple Effect

The TikTok saga is a microcosm of the broader U.S.-China tech cold war. It demonstrates a shift from outright decoupling to managed interdependence. The U.S. achieved its goal of severing direct Chinese control over a critical information platform without causing the shock of a ban. China avoided the humiliation of a forced fire sale, preserving face and substantial economic value.

However, the compromise sets a complex precedent. It legitimizes the use of national security law to force corporate restructuring of foreign-owned apps, a tool other countries may now wield. It also creates a new class of hybrid tech entities, neither fully domestic nor foreign, which will navigate a labyrinth of conflicting loyalties and regulations for years to come.

Conclusion: A New Model for a Fractured Internet

The TikTok deal is not an endpoint, but a blueprint. It concludes a five-year showdown by inventing a new corporate form for the age of digital sovereignty. As the January 2026 closing date approaches, the world will watch to see if this intricate balance of power, profit, and data security holds. Its success or failure will determine not just the future of a single app, but the shape of the global internet itself, proving that in modern geopolitics, even a ban can be negotiated into a joint venture.