4 min read • 691 words

Introduction

A political firestorm has erupted over the future of higher education funding. Chancellor Rachel Reeves has mounted a robust defence of the current student loan framework, branding it ‘fair and reasonable,’ just days after a scathing critique from consumer champion Martin Lewis. This clash exposes a deep national rift over who should bear the cost of university degrees in an era of economic strain.

A Chancellor on the Defensive

Chancellor Reeves’s comments, delivered in a tense parliamentary session, were a direct rebuttal to accusations of moral failure. She argued the system, with its income-contingent repayments and eventual write-offs, protects lower earners. “It is a system where you only pay back if you are earning above a certain threshold,” Reeves stated, framing it as a progressive pillar of social mobility rather than a blanket debt burden.

The Voice of the Consumer: Lewis’s Moral Outrage

The catalyst for this debate was money-saving expert Martin Lewis. He lambasted the government’s recent decision to freeze student loan repayment thresholds for five years as “not a moral thing.” This freeze, he explained, is a stealth tax hike on graduates. By not adjusting thresholds with inflation, millions will repay more, for longer, silently eroding their take-home pay during a cost-of-living crisis.

How the ‘Stealth Tax’ Actually Works

The mechanics are technical but consequential. Currently, Plan 2 graduates repay 9% of earnings over £27,295. Freezing that threshold until 2026, while wages nominally rise, pulls more people into repayment and increases sums for existing payers. The Institute for Fiscal Studies estimates this will affect over 2 million graduates, adding an average of £15,000 to lifetime repayments. It’s a fiscal move with profound personal impact.

Broader Context: A Generation Under Financial Strain

This dispute isn’t happening in a vacuum. It touches the raw nerve of generational inequality. Today’s students face tuition fees nearly triple those of two decades ago, coupled with soaring living costs. They enter a workforce marked by stagnant wage growth and housing unaffordability. For them, the loan isn’t an abstract concept but a defining feature of their financial adulthood, colouring decisions on careers, homes, and families.

The Philosophical Divide: Investment vs. Burden

At its core, the debate hinges on a philosophical question: is a university degree a personal investment or a public good? Reeves’s defence leans toward the former, emphasising the graduate premium in earnings. Critics, however, argue this view is outdated. They point to the dilution of that premium and the essential need for a skilled workforce, advocating for a return to greater state subsidy to unlock potential.

International Perspectives on Funding

The UK’s model sits in a global spectrum. England has one of the most expensive systems in the developed world. Contrast this with Germany, where tuition is free, or Scotland, where it is free for home students. Australia uses a similar income-contingent loan model but with lower interest rates. These comparisons fuel the argument that alternative, fairer models are not just theoretical but operational elsewhere.

Political Ramifications and the Youth Vote

The government’s stance carries significant political risk. With a general election on the horizon, alienating millions of young graduates and current students could be costly. Political analysts note that the “youth vote” is increasingly volatile and single-issue policies like student debt can drive turnout. The opposition is already seizing on this, framing the threshold freeze as a betrayal of a generation.

The Road Ahead: Reform or Stasis?

What comes next? The Treasury appears dug in, citing fiscal constraints. Yet, pressure is building from backbench MPs, student unions, and influential voices like Lewis. Potential compromises could involve a shorter freeze, a higher starting threshold for future cohorts, or a review of the controversial real interest rates applied to loans. The system’s long-term sustainability is now under unprecedented scrutiny.

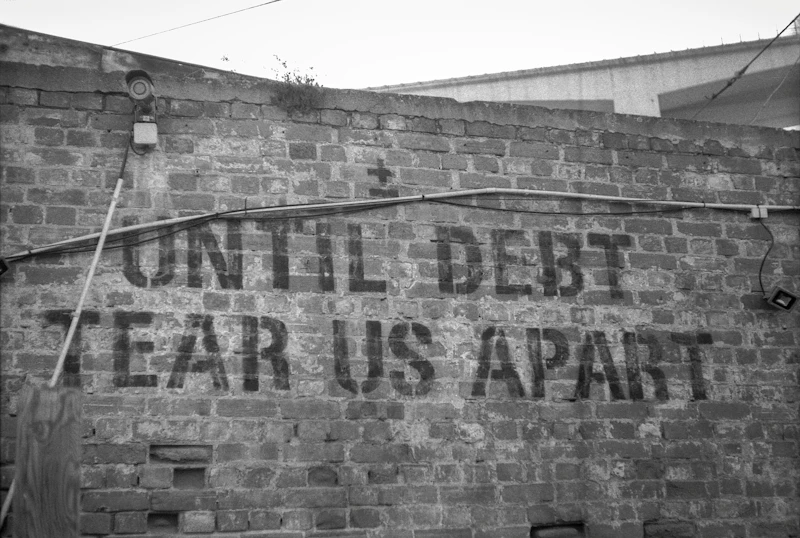

Conclusion: A Debt on the Nation’s Conscience

The chancellor may declare the system fair, but for a generation grappling with its reality, fairness feels like a distant abstraction. The freeze on repayment thresholds has ignited a broader conversation about value, equity, and intergenerational contract. As graduate debt balloons into a defining socio-economic issue, the government’s defence may need to evolve beyond reasonableness to address a palpable sense of grievance that shows no sign of abating.