Introduction

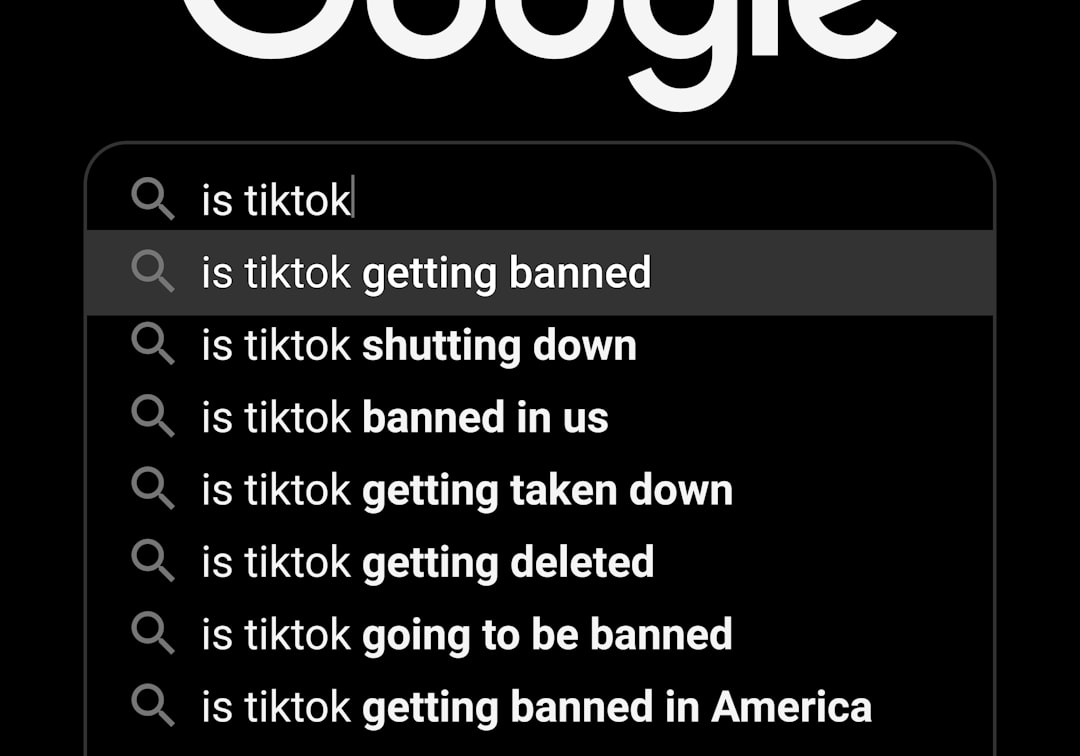

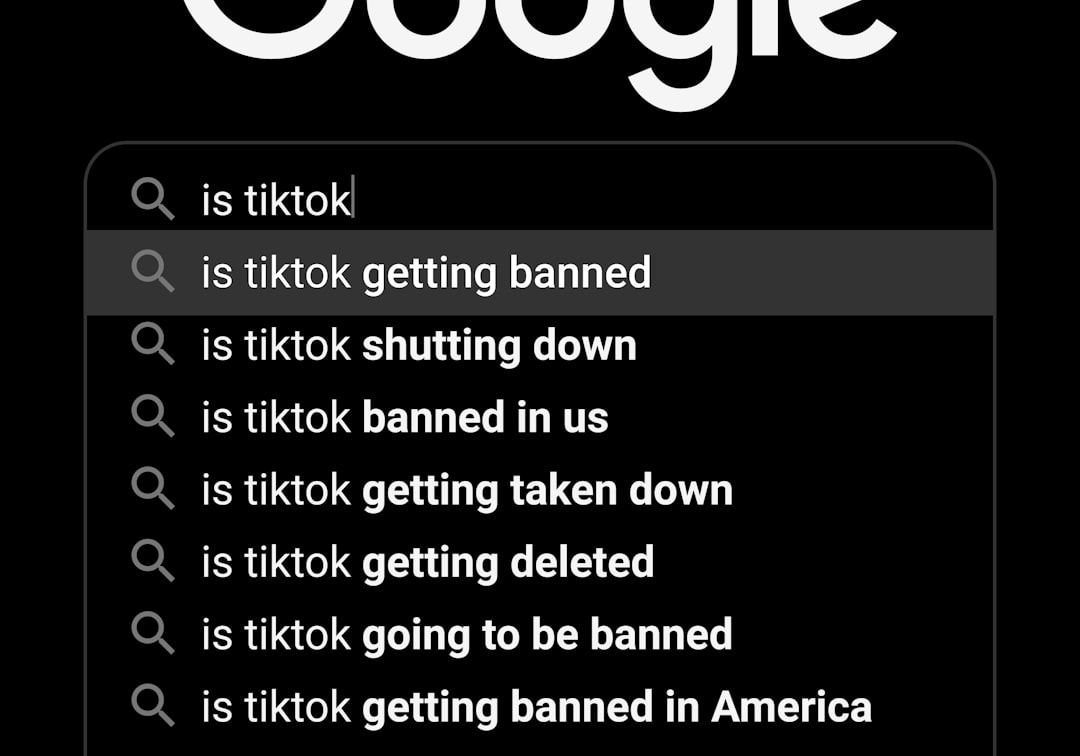

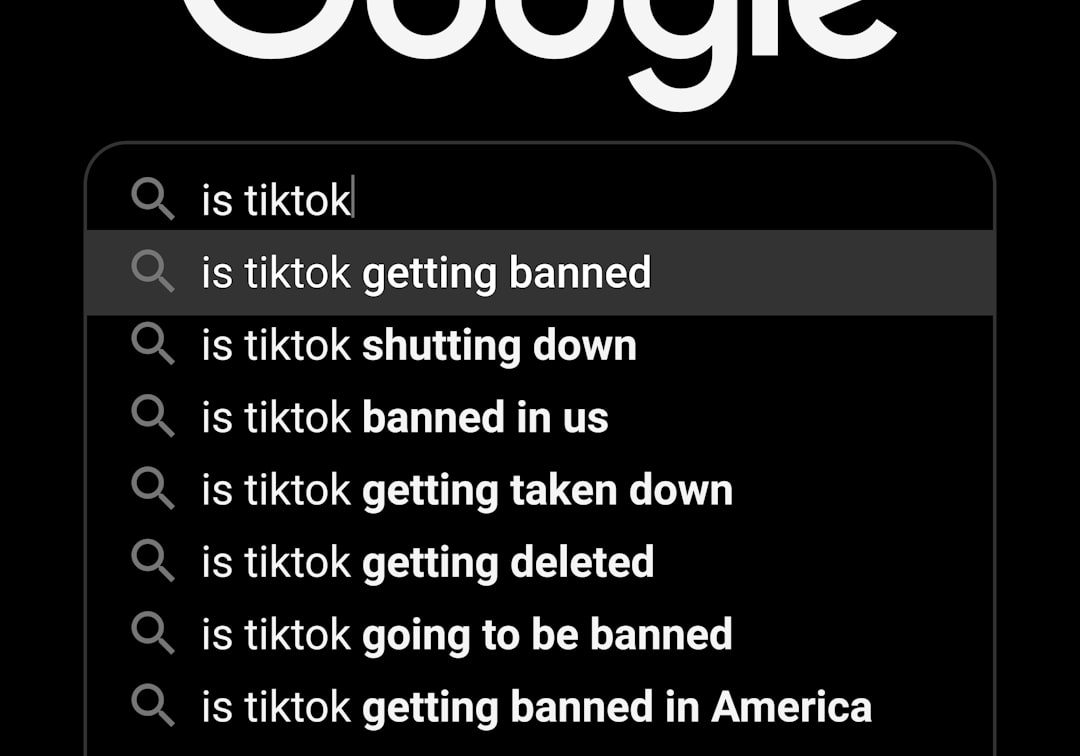

A digital standoff that threatened to erase an app from 170 million American phones has reached a stunning, multi-billion dollar détente. After years of geopolitical wrangling, TikTok will remain in the U.S. under a radical new corporate structure, with Oracle at the helm of a consortium buying its U.S. operations. This unprecedented deal reshapes the social media landscape and sets a new precedent for how tech sovereignty is negotiated in the 21st century.

The Deal That Defused a Digital Bomb

The agreement, finalized in mid-December, creates TikTok USDS Joint Venture LLC. Oracle, alongside investment giants Silver Lake and MGX, will become part-owners, with the transaction expected to close by January 22nd, 2026. Crucially, ByteDance will retain a significant, though non-controlling, stake. This complex structure aims to satisfy U.S. national security concerns by placing American data and algorithm security under domestic oversight while allowing the app’s core experience to continue.

A Labyrinth of Legal Extensions and Negotiations

The path to this deal was anything but straightforward. The “divest-or-ban” law, effective January 19th, initially forced a brief, shocking blackout of the app in U.S. stores. A series of presidential extensions, signed by Donald Trump, repeatedly pushed enforcement deadlines back, buying time for fraught negotiations between Washington and Beijing. Each extension underscored the law’s high-stakes complexity and the immense economic value at play.

Oracle’s Cloud Castle: The Technical Heart of the Deal

Oracle’s role extends far beyond financial investment. The company will become the secure cloud provider for all U.S. user data, a prize long sought by founder Larry Ellison. Furthermore, Oracle engineers will oversee a “newly-retrained” version of TikTok’s famed recommendation algorithm. This “algorithmic firewall” is the deal’s technical cornerstone, designed to ensure no foreign manipulation of the American information feed.

Content and Control: The New Governance Model

The joint venture, led by CEO Shou Zi Chew, will assume full responsibility for data protection, content moderation, and platform deployment for U.S. users. This creates a novel, bifurcated governance model where the U.S. entity operates with significant autonomy. Analysts see this as a blueprint for other globally contentious apps, establishing a template for localized control without a full corporate divorce.

The Geopolitical Chess Game

This resolution is a diplomatic tightrope walk. China has long opposed a forced sale of TikTok’s core technology, viewing its algorithm as a strategic asset. The joint venture structure represents a compromise, avoiding a full, politically untenable strip-sale. For the U.S., it achieves the primary goal of severing operational control from ByteDance while preventing a disruptive ban that would anger millions of voters and creators.

Economic Stakes and the “Tremendous Fee”

While financial terms are not fully public, estimates place the value of TikTok’s U.S. operations between $50-$60 billion. President Trump’s claim that the U.S. would receive a “tremendous fee” likely refers to substantial tax revenues from the transaction and ongoing operations. The deal also spares the U.S. economy from the shock of dismantling a creator ecosystem valued in the tens of billions.

Unanswered Questions and Lingering Doubts

Despite the signed agreements, skepticism persists. Can an algorithm truly be split and “retrained” without degrading the user experience that fueled TikTok’s rise? How will content moderation policies diverge between the U.S. and global versions? Some lawmakers express concern that any retained ByteDance influence, however minor, could leave a backdoor open, suggesting oversight will be relentless and unforgiving.

The Creator Economy’s Sigh of Relief

For millions of American small businesses, artists, and influencers, the deal ends a prolonged period of existential anxiety. A ban would have vaporized livelihoods built over years. The continuity provided by the joint venture allows this digital economy to stabilize and grow, though within a new, more scrutinized regulatory framework. Trust in the platform’s longevity, however, may take time to fully rebuild.

Conclusion: A New Era of “Splinternet” Governance

The TikTok saga concludes not with a ban, but with a groundbreaking corporate experiment. It signals a move toward a more fragmented internet, where data sovereignty dictates corporate structure. The success of the TikTok USDS Joint Venture will be closely watched by regulators worldwide, potentially inspiring similar models for other global platforms caught in the crossfire of international data politics. The deal saves the app, but it permanently alters the principle of a borderless web.