4 min read • 723 words

Introduction

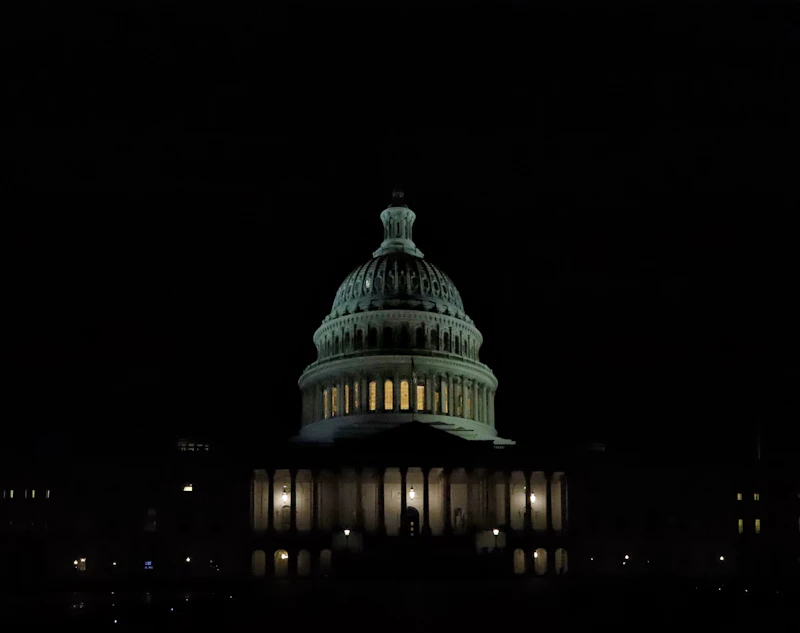

In the hushed corridors of Capitol Hill, a rare and fragile consensus was forming. A landmark bill, poised to finally bring legal clarity to America’s multi-trillion-dollar crypto sector, stood on the precipice of becoming law. Then, with a single strategic misstep, the industry’s leading exchange shattered the political détente, leaving its future in regulatory limbo. This is the story of how Coinbase’s high-stakes gamble derailed a decade of political progress.

A Bipartisan Breakthrough on the Brink

By early 2026, the stars had aligned for digital asset regulation. The CLARITY Act, having sailed through the House, awaited Senate negotiation. It promised to definitively separate securities from commodities, assign regulatory roles, and establish consumer protections. The White House signaled readiness. Democrats and Republicans, for once, agreed on core principles. After years of operating in a gray zone, the industry was weeks from a foundational legal framework that would legitimize its place in the global financial system.

The Coinbase Conundrum: Principle or Provocation?

At this critical juncture, Coinbase CEO Brian Armstrong made a fateful decision. Rather than quietly shepherding the CLARITY Act to completion, the exchange launched a public, aggressive campaign targeting a specific senator pivotal to the bill’s passage. Leveraging its user base, Coinbase framed the senator as an obstructionist to innovation, flooding offices with calls and emails. The move, intended to apply pressure, was viewed on the Hill as a profound breach of political protocol and a declaration of war.

The Backfire: Uniting Foes and Alienating Friends

The backlash was immediate and bipartisan. Legislators who had championed the bill felt blindsided and disrespected. “It was the ultimate act of bad faith,” one Senate aide confided. “We were crafting their lifeline, and they tried to burn down the workshop.” The targeted senator gained sympathy, hardening their position. The collaborative atmosphere evaporated, replaced by resentment. Coinbase’s action transformed the debate from policy to punishment, uniting often-opposed factions against a common, perceived antagonist.

Context: A History of Regulatory Tension

This incident didn’t occur in a vacuum. For years, the Securities and Exchange Commission (SEC) has engaged in a “regulation by enforcement” campaign against crypto firms, including a high-profile lawsuit against Coinbase itself. The industry has argued this approach stifles innovation and creates uncertainty. The CLARITY Act was seen as the legislative solution to this standoff, creating clear rules of the road. Coinbase’s maneuver, born of this protracted frustration, ultimately sabotaged the very process meant to end it.

The Ripple Effect Across the Industry

The fallout extended far beyond a single bill. Overnight, crypto lobbyists found doors once open now firmly shut. Competing firms, who had invested millions in careful diplomacy, were furious. “They set fire to the entire village to save their own house,” lamented the CEO of a rival blockchain firm. The industry’s reputation, painstakingly built to appear compliant and mature, was tarnished. The episode provided ammunition to crypto skeptics who argue the sector is fundamentally adversarial to regulated governance.

A Strategic Miscalculation in Timing and Tone

Analysts point to a dual failure in Coinbase’s calculus. First, the timing was catastrophic, attacking a process at its most delicate legislative stage. Second, the tone was confrontational when collaboration was paramount. “They treated a nuanced political negotiation like a social media mob campaign,” noted a Georgetown University political strategist. This misread of Washington’s culture—where relationships and behind-the-scenes work often trump public pressure—proved devastatingly costly.

The Path Forward: Picking Up the Pieces

In the wake of the debacle, the immediate future for crypto regulation is bleak. The CLARITY Act is stalled indefinitely. The SEC is likely to redouble its enforcement-first approach, emboldened by the industry’s demonstrated inability to navigate Congress. States may accelerate their own, fragmented regulatory schemes, creating a patchwork compliance nightmare. The onus is now on the industry to rebuild burned bridges, a task that may take years and require new leadership at the advocacy forefront.

Conclusion: A Cautionary Tale for Tech Politics

The Coinbase saga serves as a stark lesson for all technology sectors engaging with Washington. Disruptive innovation does not grant a pass on political nuance. The episode underscores that legislative progress is a fragile construct, vulnerable to hubris and misapplied pressure. For crypto, the dream of clarity has been deferred, not by skeptical regulators, but by a self-inflicted wound from its own champion. The road back will require less brash disruption and more humble, sustained diplomacy.